10 Things the RICH Teach Their Kids about MONEY

As we all know the subject of money isn't taught in schools most people learn about the topic of money at home from their parents but what our parents actually teaching their kids about money what makes a difference between somebody who will eventually become rich and successful and someone who won't so today let's go over ten things that rich teach their kids about money that the poor don't if you like Articles about business money in psychology make sure to Follow our blog so you don’t miss any of our latest Article and I got a big surprise for you at the end of this Article and let's get started

1. Rich Parents Teach the Importance of Money

2. The Difference between Assets and Liabilities

3. How to Manage Their Money

4. Different Ways to Earn Money

5. Developing Productive Habits

6. No One Owes You Anything

7. Social and Influence Skills

8. Delayed Gratification (Patience)

9. There Is Always More Money

10. The Best Way to Make Money Is To Help Others

11. Bonus. They Understand They Can't Know Everything

1. Rich Parents Teach the Importance of Money

Number one rich parents teach their kids the importance of money virtually all self-made millionaire or anyone who've achieved financial success believes that money is very important and is one of the first things they teach their kids about money. Rich parents often show how important money is regardless of whether they believe money is important for happiness or not. They know that money is important to have options and a better quality of life even if they only consider money as a resource and nothing else most rich people understand that money gives them freedom from the ability to choose their location for their next vacation to the freedom to choose where to live and even the ability to help others. They know that they can have a less financially stressful life when they have an abundance of money

The poor on the other hand rarely talk about money and some even say that money is not important this can affect their kids on the long term because they will grow up in a financially driven society while neglecting their financial life all because they think of money as not important.

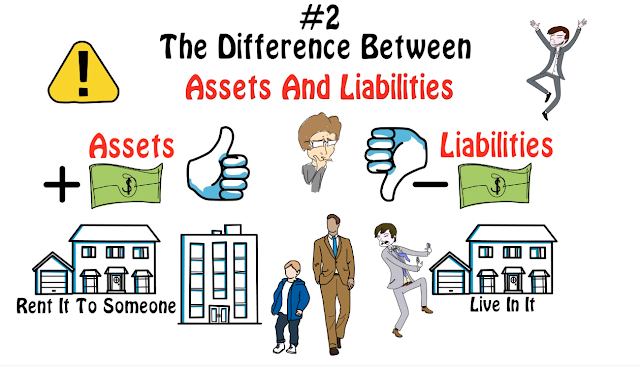

2. The Difference Between Assets And Liabilities

Number two they teach the difference between assets and liabilities. One of the most important and basic concepts of building financial independence is understanding the difference between assets and liabilities. If you haven't heard of these before assets are things that bring money into your bank account and liabilities do the opposite they take money out of your bank account for example if you buy a house and you rent it out to someone it is an asset because it brings cash flow every month in form of rent if you buy a house to live in then it's a liability because it takes money out of your pocket every month many rich parents teach their kids to build them by asset and avoid liabilities. This way they can create a business or investments that generate cash flow on a recurring basis and avoid the things that generate a negative cash flow on their bank account so they can have a surplus of money.

They also understand the power of

using assets to detach your time from your income since assets generate cash

flow whether you are physically putting in the work or not you are able to

scale and use your time to develop more assets rich people often focus on

understanding and teaching the spending patterns of the poor versus the rich

and why some people earning the same salary end up becoming rich while others

stay poor.

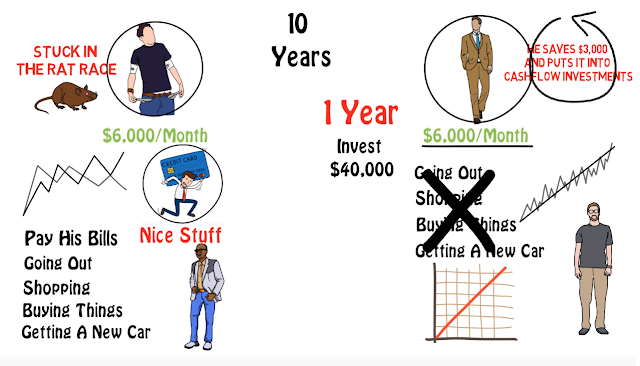

For example let's say that we have two people making six thousand dollars per month but they have very different spending patterns. The first one gets their paycheck and pays bills and enjoys his money going out shopping getting the newest phone and the latest TV indulging in the finest restaurants getting a new car, a nice house and all of that nice stuff. They typically spend their money on things that make them look good and wealthy but they actually come back home to build in a lot of debt. They typically have little to no savings and have years of debt on their credit cards car payments and mortgage payments. They are stuck in the rat race and they will take years to get out now. Let's see the second person he also makes $6,000 per month but this person does not buy a nice house or a nice car. He doesn't go out every weekend and he doesn't go to the fancy restaurants. He occasionally buys clothes when he needs them but he doesn't follow the fashion trends every season. He lives on a $3,000 a month budget and puts away the other $3,000 by the end of the year, he has $36,000 and puts them into cash flow investments that increases his monthly income. He continues living on his $3,000 a month budget and by the following year, he's able to invest in at 36 but $40,000 since he increased the income into investments that generate cash flow ten years later these two individuals will be in two completely different places all due to their spending habits.

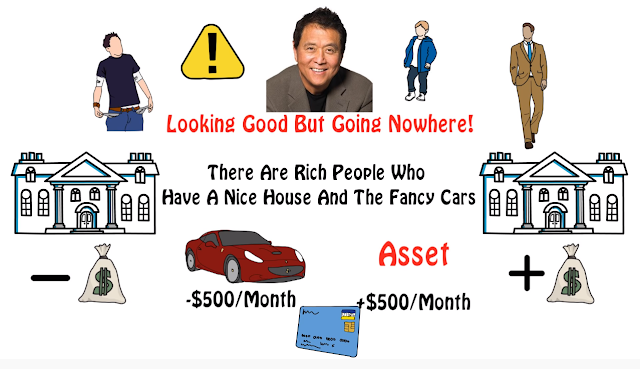

There's a quote from Robert Kiyosaki that says looking good but going nowhere. Which means that many people spend their money to look a rich, while actually being poor in the meantime rich people look poor while getting rich. Now a lot of people might be saying there are a lot of rich people who have nice things nice houses fancy cars and all of that luxury stuff and yes it's true but the main difference here is that poor people use their own money or go in debt to buy their luxuries. The rich have their assets buy luxuries for them if you want a car that costs you 500 dollars per month well it's time to build another asset that generates you $500 or more per month this way your bank account is unaffected when you buy this liability that is another crucial element that many rich parents teach their kids.

3. How To Manage Their Money

Number three how to manage their money a very good way many wealthy parents teach their kids about money is by letting them into their planning and managing of their household expenses many of these parents include their kids when they go over their financial statements and plan their budgets they often familiarize their kids on the reality of having living expenses. This gives their children the experience of managing money from an early age which can help when they grow older and they have to manage their own money. This is a big contrast to many parents with a poor mentality the majority of parents rarely talk about money especially their own income they typically plan their monthly budgets without their kids. if they even plan at all and often associate a negative attitude when planning their monthly expense budget oftentimes parents argue and express negative feelings about planning their monthly budgets causing their kids to take on similar planning patterns which translates to similar behaviors later in life. Rich parents know that living expenses are a reality of the modern life and focus on associating good emotions on their living expenses as odd as that might sound many people are grateful for those living expenses because it provides them with a roof over their heads and the ability to live comfortably.

4. Different Ways To Earn Money

Number four the different ways of earning money one thing that I've noticed many wealthy parents teach their kids is that different ways to earn money did you know that the daughter of former President Barack Obama had a normal customer service job many other wealthy people have their kids get a normal job there are a few reasons for this but one of them is to be able to have them experience that different ways money is earned and teach them how each of them work for example one of them is exchanging time for money whether that is working on a job or freelancing. The second is to build systems that generate you money or having money work for you like building a business and leveraging the time of other people as employees leveraging online systems that provide automation or using money to buy assets that generate income for you.

Which is illustrated in the book cash flow quadrant by Robert Kiyosaki. The rich focus on understanding and teaching these principles to give their kids the freedom to not be stuck and only one way of making money but give them the ability to learn the other ways money is made on the other hand most poor parents only know one way of making money which is typically exchanging time for money and sadly is the only thing they teach their kids and they eventually grow up only knowing one way to make money which limits their true earning potential.

5. Developing Productive Habits

Number five developing productive habits. The Rich know that is not what you do that makes you wealthy but what you do consistently. If the wealthy parents are self-made they know that in order to achieve financial wealth they must work and carry out their plans on a consistent basis is not just about taking action once or working hard once but doing it over up her long period of time and the best way to do that is by building habits. Things that you come to do naturally so many wealthy parents focus on developing productive habits on their children so they can attract wealth themselves more naturally in the future. This can be as simple as starting their day with a set of accomplishments or to always look at how they can bring value to others not only that but many wealthy parents teach their kids how to build their own habits. Learning how to build habits is one of the best skills anyone can have understanding the psychology behind modifying your own habits can be extremely powerful for our child's long-term success.

6. No One Owes You Anything

Number six no one owes you anything self-made millionaires and those who got wealthy with their own work know how much it takes to create wealth for them and their they know that they will only get what they fight for and no one owes them anything this is especially important for rich people because in many occasions their kids grew up in a wealthy environment where they can feel like they deserve to have a piece of their parents wealth they understand that this sense of entitlement can be a huge disservice to their kids in the future and teaching a concept of earning your success becomes very important to them Bill Gates and Warren Buffett two of the richest men in the world have similar philosophies they will not leave their kids with their wealth and will only leave them with a minuscule amount of inheritance as Bill Gates said in an interview in 2011 they have to find their own way. They try to install a sense of Independence and hard work so their kids can find their own success.

7. Social And Influence Skills

Number seven social and influence skills this is something that isn't talked about enough in the financial and business world but is one of the most important. The ability to socialize and communicate with others can open up a lot of opportunities that otherwise wouldn't happen the ability to create influence with those around you. Creates a sense of leadership, installing that skill to understand people's emotions, motivations and behaviors early on can provide an incredible tool for the future setting kids up to be strong and influential leaders.

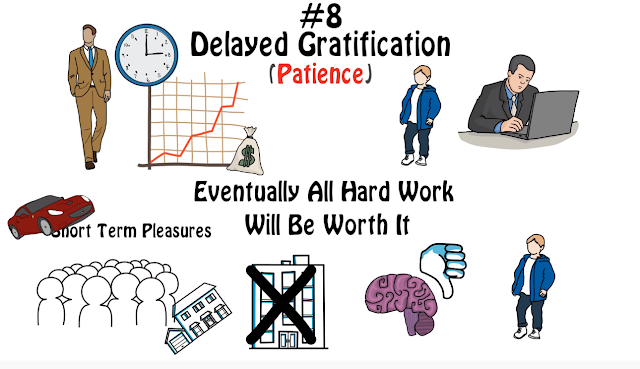

8. Delayed Gratification (Patience)

Number eight delayed gratification in other words patience the rich understand that completing a massive goal then building wealth takes time and they must be patient while working hard at their craft and that is one of the skills they often teach their kids that eventually their hard work will pay off the majority of people prefer short-term pleasures like buying the nice car or the fancy house right away or they might start a business and leave when it's not profitable in the first year and they pass down the same behaviors to their children. I really like something that Gary Vaynerchuk says when it comes to this topic and that is to have micro speed and macro patience meaning we must work hard consistently every day and be patient for the big picture as he says most people are slow on the day-to-day and want to be successful the next day.

9. There Is Always More Money

Number nine there is always more money an incredibly important mindset that the rich have is that there is always more. Most people think that there is a limited amount of money in the world and that believe translates to their bank accounts. While the poor might feel like there is not enough money to rich know that there is always more money out there. Whether it's to fund a new business or take a vacation they know that there is a lot of money out there and their job is to get it. The poor think that their salary is their financial limit and they will have to live under this financial ceiling which is a scarcity driven mindset the original that there is no limit on how much they can earn and money is out there waiting for them to attract it which is an abundant mindset this is a simple concept that can play a major role in our financial decisions while most people focus on saving money and reducing cost the rich focused on increasing their income this doesn't mean that the rich don't focus on reducing the expenses but they invest more time and energy in increasing their cash flow over reducing a few small expenses as a business owner having a scarce mindset can limit the entrepreneur earning potential there are many entrepreneurs who don't charge what they deserve for their products and services simply because they feel guilty for charging money to others they might feel like they are doing a disservice to their clients by taking their money but an entrepreneur with an abundant mindset knows that anyone has enough money for the things they really want and if a potential customer wants their product who are they to deny it.

If you take a look at society people always have money for the things that they really want if they want to go on a nice vacation they spend months saving for it if they want to invest in their education they will work an extra shift to buy that course if they want to begin investing they will work hard and save to start investing there is always more money for the things we want our job is to go and get it.

10. The Best Way To Make Money Is To Help Others

Number 10 the best way to make money is to help others an important lesson that the rich teach their kids is that the most powerful way to make money is to solve other people's problems and the bigger the problem the bigger the paycheck it is no secret that the most successful people in the world have solved or at least aid in solving big problems in the world from Steve Jobs for revolutionary in the technology music and communication industry to Henry Ford for transforming the personal transportation industry to Oprah Winfrey for making a global impact in the self-development world. All made a huge impact in helping others solve a problem most poor people focus on getting paid based on tasks efforts and time while the rich focus on providing results and solving problems providing value is the rich person's game and they get paid based on the amount of value they provide in.

11. Bonus. They Understand They Can't Know Everything

A bonus one number eleven they understand they don't know everything something that the majority of people don't know is that rich and successful people get together in groups called masterminds. They know that it is impossible for them to know everything so they spend time with others. Who know things they don't, so they can improve their own business and their own life. They seek mentors and coaches who are experts and the things that they wish to learn and they are constantly developing new skills.

0 Comments